Basic approach to corporate governance

The Ricoh Leasing Group is committed to good corporate governance,with the dual objectives of ensuring management transparency in accordance with business ethics and the spirit of compliance, and strengthening the Group's competitiveness. We are also striving for sustainable growth and enhancement of our corporate value by building trust with our stakeholders, who we define as our customers,business partners, employees and society.

We will continue working to further strengthen and improve corporate governance by constantly reconsidering the framework according to social, environmental and legislative changes.

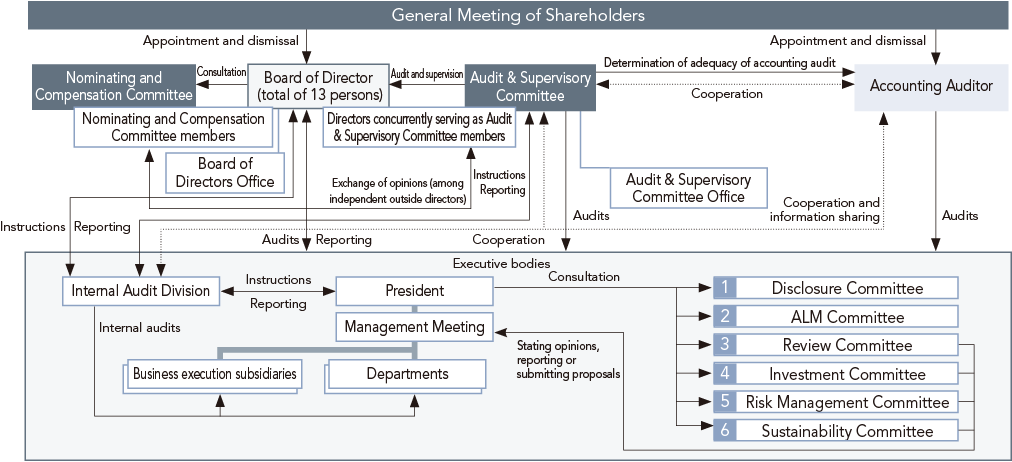

Diagram of corporate governance system (As of June 23, 2025)

Outline of corporate governance

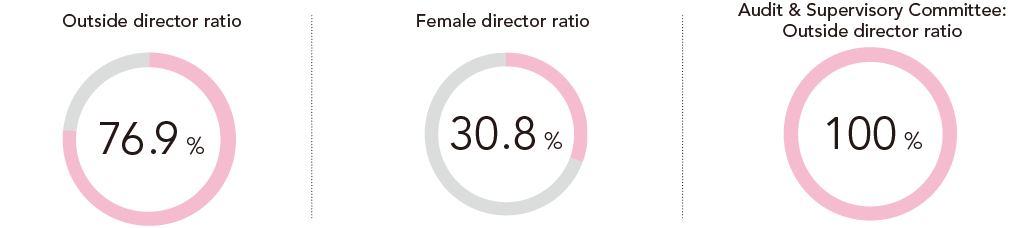

(As of June 24, 2024)

| Organizational form | Company with an audit and supervisory committee |

|---|---|

| Executive Officer system | Yes |

| Chairperson of Board of Directors | Representative Director, President and Chief Executive Officer |

| Directors |

13 persons (including 10 outside directors and 8 independent outside directors) 10 directors who are not members of the Audit & Supervisory Committee (including 7 outside directors and 5 independent outside directors) 3 directors who are members of the Audit & Supervisory Committee (all are independent outside directors) |

| Board of Directors meetings and attendance※1 | 14 meetings / Average attendance rate of directors: 100% |

| Advisory body to the Board of Directors | Nominating and Compensation Committee comprising 5 members (all of whom are independent outside directors; however, excludes directors who are Audit & Supervisory Committee members) |

| Audit & Supervisory Committee meetings and attendance※1 | 23 meetings / Average attendance rate of Audit & Supervisory Committee members: 100% |

| Provision of incentives to directors |

Bonus linked to single-year earnings (short-term incentives) Stock-based remuneration※2 (medium- and long-term incentives) |

- ※1FY2023

- ※2Equity trust method

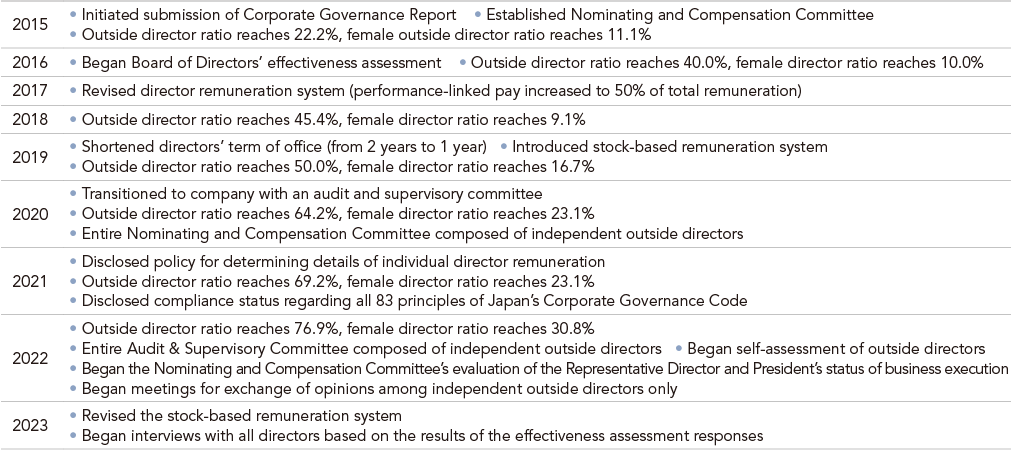

Record of initiatives for enhancement and reform of governance

Board of Directors

The Board of Directors comprises 13 directors (including 3 directors who are members of the Audit & Supervisory Committee). And of the 13 directors, 10 are outside directors (including 3 directors who are members of the Audit & Supervisory Committee) who deliberate on and make decisions pertaining to matters stipulated by law and regulations and the Articles of Incorporation, as well as other matters such as important affairs related to management.

The Company has adopted the structure of a company with an audit and supervisory committee, and based on the provisions of the Articles of Incorporation, a considerable portion of key business decisions are delegated to management, which enables prompt and flexible decision making. The Board of Directors deliberates on and makes decisions on matters such as management plans, while providing supervision over the execution of duties by individual directors and executive officers.

At fiscal 2023 Board of Directors meetings, in addition to monitoring such as regular monthly financial reporting, sales reporting, and reporting of the business operations of each division, there were discussions on management conscious of the Company's cost of capital and stock price. Furthermore, the Board of Directors is informed of matters discussed and reviewed by the Company's Sustainability Committee, which oversees, discusses, and advises on the status of efforts to meet the human-capital-related and climate-change-related non-financial targets set forth in the Mid-term Management Plan (FY2023-2025). In addition to the Board of Directors meeting, a deliberative meeting on the Mid-term Management Plan was also held with the participation of all directors, including internal and outside directors. As a result, a high percentage of respondents offered high ratings of the Board of Directors' effectiveness in its fiscal 2023 assessment, confirming that the Board of Directors is functioning effectively.

Voluntary advisory committee

As an advisory body to the Board of Directors, Ricoh Leasing has established a Nominating and Compensation Committee consisting entirely of independent outside directors (excluding directors who concurrently serve as Audit & Supervisory Committee members) for the purpose of ensuring the objectivity, transparency and adequacy in the appointment of director candidates, the appointment and dismissal of management team members, the formulation and administration of succession plans for the CEO and the determination of directors' remuneration. The Company has also established the following committees as advisory bodies to the President and CEO.

- Disclosure Committee: TFor the purpose of effectively and efficiently disclosing corporate information regarding the Ricoh Leasing Group

- ALM Committee: For the purpose of properly managing assets and liabilities to properly manage risks and maximize profit

- Review Committee: For the purpose of deliberating and determining review-related matters and reporting on review-related matters

- Investment Committee: For the purpose of deliberating investments in entities and monitoring and reporting on investees, etc.

- Risk Management Committee: For the purpose of promoting risk management through the exhaustive and comprehensive control of risks and the avoidance and prevention of losses by the Ricoh Leasing Group

- Sustainability Committee: For the purpose of more effectively supporting sustainability management across the Ricoh Leasing Group

Nominating and Compensation Committee

As an advisory body to the Board of Directors, Ricoh Leasing has established a Nominating and Compensation Committee consisting entirely of five independent outside directors (excluding directors who concurrently serve as Audit & Supervisory Committee members) for the purpose of ensuring objectivity, transparency and adequacy in the appointment of director candidates, the appointment and dismissal of management team members, the formulation and administration of succession plans for the CEO and the determination of directors' remuneration.

Nominating

In fiscal 2023, through interviews with the President and CEO, the Company decided to reappoint him to the same position based on an evaluation from the perspective of corporate performance, sustainable growth, and medium- to long-term improvement in corporate value. These interviews also served to discuss and deliberate the succession plan for the President and CEO from the perspective of human resource development. In addition, several sessions were held to discuss the issue of outside directors, which has become increasingly important not solely as an internal issue. The Board also deliberated on the structure of the Board of Directors after June 2024, referring to the candidates' career history and the reasons for their selection. As in the previous fiscal year, a self assessment of outside directors was conducted this year, and a summary of the results was reported to the Nominating and Compensation Committee and the Board of Directors.

Compensation

In fiscal 2023, the Nominating and Compensation Committee reviewed the results of the officer remuneration survey and discussed the status of the remuneration structure for directors, as well as the extension of the trust period for officer stock-based remuneration. In addition, the committee conducted a performance evaluation of the directors, including the President, and determined the performancelinked remuneration calculation and the details of the report to the Board of Directors.

Audit & Supervisory Committee

The Audit & Supervisory Committee of the Company audits and supervises the Board of Directors' decision-making process and the execution of duties by the management team, through activities such as exercising voting rights at meetings of the Board of Directors and exercising the right to state opinions on personnel matters and remuneration of directors (excluding directors who concurrently serve as Audit & Supervisory Committee members) at the General Meeting of Shareholders, attending meetings of the Board of Directors, the Management Meeting, and other important meetings, looking over key documents and examining the status of business operation and assets. The Audit & Supervisory Committee consists of three members, all of whom are highly independent outside directors. In addition, there is one fulltime Audit & Supervisory Committee member to make for smooth audits by the Audit & Supervisory Committee.

The resolutions, matters reported on, shared, deliberated, and discussed, as well as the other work done by the Audit & Supervisory Committee throughout fiscal 2023 are as follows.

| Resolutions | Assignment of the duties of Audit & Supervisory Committee members, establishment of evaluation and selection criteria for accounting auditors, reappointment of accounting auditors, consent to audit fees for accounting auditors, submit Audit & Supervisory Committee audit reports, consent to proposed appointments of substitute Audit & Supervisory Committee members, etc. |

|---|---|

| Matters reported on and shared | Reporting on audit plans and audit summaries from accounting auditors, reporting on financial closing policies and financial closing overviews from the Accounting Department, reporting on the implementation of internal audit, reporting on basic policies and operation status of internal control systems from the Internal Control Office, and reporting on the summaries of important meetings such as the Management Meeting and advisory committee meetings, etc. |

| Matters deliberated and discussed | Audit & Supervisory Committee activity policy, establishment of priority audit themes, prior confirmation of agenda items on the days of Board of Directors meetings, consideration of Nominating and Compensation Committee agenda, discussion of key audit matters (KAM) and other audit issues and matters of concern with accounting auditors, evaluation of accounting auditors, etc. |

Assessment of Board of Directors' effectiveness (FY2023)

To continuously enhance and improve the effectiveness of the Board of Directors, the Company assessed the effectiveness of the Board of Directors by conducting a survey, targeting all directors and corporate auditors (including Audit & Supervisory Committee members) regarding deliberations on the Board's responsibilities and the status of its operation.

Implementation Guidelines

<Analysis and evaluation process>

⑴ Questionnaire of all directors (13), including internal and outside, conducted from January to February 2024

⑵ Summary of results from the questionnaire in ⑴ above reported at the March Board of Directors meeting

⑶ Based on the results of the questionnaire in ⑴ above, conducted interviews with all directors during March 2024 in order to further investigate their awareness of the issues regarding the Company's Board of Directors

⑷ Based on the results of the questionnaire in ⑴ above and the results of the interviews in ⑶ above, reported and deliberated on the results of the Board of Directors effectiveness assessment and measures to further improve effectiveness at the Board of Directors meeting in May 2024

<Questionnaire items>

The key items in the FY2023 questionnaire were as follows. Each question was assessed on a four-point scale (with qualitative assessment items included), and an additional column allowed responses to be made freely on each item.

Ⅰ. The status of discussions at Board of Directors meetings

Ⅱ. The size and composition of the Board of Directors

Ⅲ. Management of the Board of Directors

Ⅳ. The support system for outside directors

Ⅴ. Operational status of committees (for Audit & Supervisory Committee members and Nominating and Compensation Committee members only; excluding certain members)

Ⅵ. Overall assessment

Issues identified in previous survey and initiatives in response

| Discussion on the appropriate development of internal control and risk management systems should be enhanced |

|

|---|---|

| Follow-up and support for newly appointed outside directors should be strengthened |

|

Issues identified in this year's survey

Evolving discussion regarding the business portfolio

Under the current Mid-term Management Plan, we are building a diversified business portfolio by strengthening existing businesses and expanding new businesses. As the concept of management conscious of cost of capital becomes more broadly instilled in our organization, we will continue to study the details of data classification and allocation in order to advance discussions regarding the business portfolio.

Activities of the Nominating and Compensation Committee

Although reports on the activities of the Nominating and Compensation Committee are reported to the Board of Directors, efforts will be made to further ensure transparency and improve understanding of the committee’s activities beyond this scope.

Best practices regarding Board of Directors meeting materials

Board of Directors meeting materials tend to scale in complexity alongside new business initiatives and the increasing complexity of business. Therefore, in order to operate the Board of Directors more efficiently, we will continue to review the composition and other elements of materials for Board meetings.

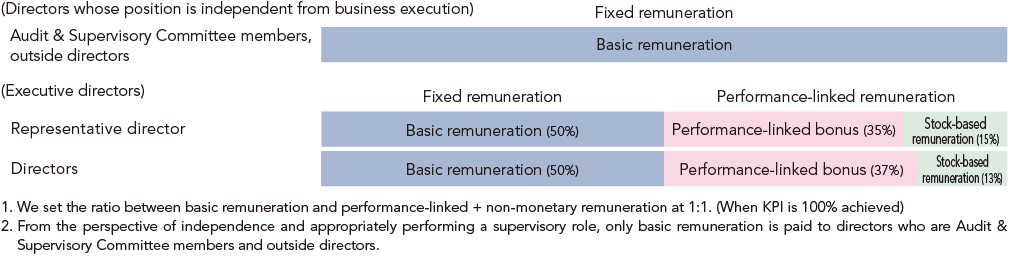

Remuneration and evaluation system for directors

The Company's remuneration for directors consists of basic remuneration as fixed remuneration, performance-linked remuneration, and stock-based remuneration. From the perspective of independence and appropriately performing a supervisory role, only basic remuneration is paid to directors who are Audit & Supervisory Committee members and outside directors. (Please refer to the table below for approximate percentages of each kind of remuneration.)

Performance-linked remuneration are determined based on business performance indicators, including ⑴ consolidated operating profit, ⑵ consolidated operating profit achievement rate, and ⑶ ROA, while the employee happiness score (employee engagement score), which is part of the non-financial targets of the Mid-term Management Plan (FY2023-2025), is used as a non-financial indicator in the calculation formula.

Non-financial indicators are also incorporated into the formula for calculating stock-based remuneration, with evaluations from an external ESG research organization used as an indicator.

In addition, in the process for evaluating the business execution by the Representative Director, President and Chief Executive Officer, the Nominating and Compensation Committee conducts said evaluation after interviews regarding target setting and evaluation. The evaluation of executive directors, excluding the Representative Director, is made by the Representative Director, President and Chief Executive Officer in consultation with the Nominating and Compensation Committee and is determined in accordance with the report of the committee.

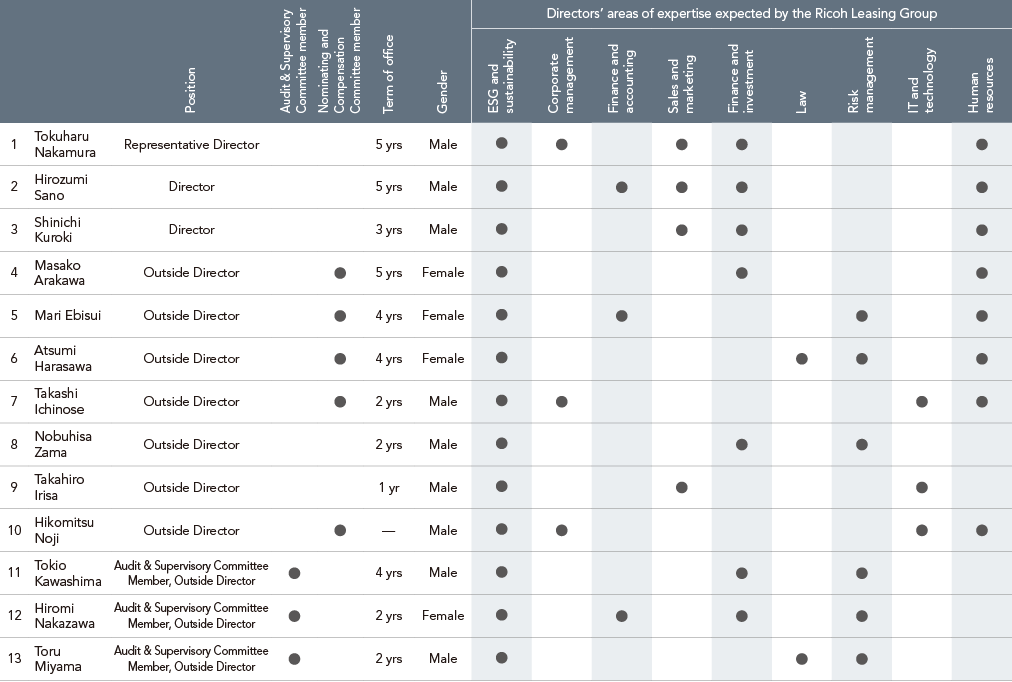

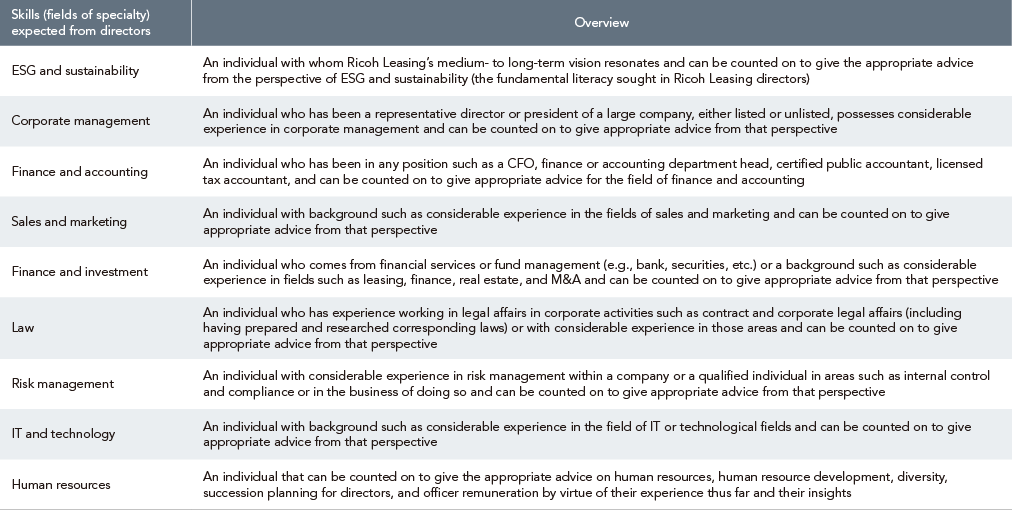

Directors' skill matrix

The areas in which we hold expectations for each director are as follows. These illustrate the areas in which we have particularly strong expectations in each director to apply their insights and knowledge for the benefit of the Company. Since we appoint as directors individuals who share our medium- to long-term vision of becoming a Circulation-Creating Company and possess fundamental literacy in ESG and sustainability, all directors have earned a mark in the ESG and sustainability column.

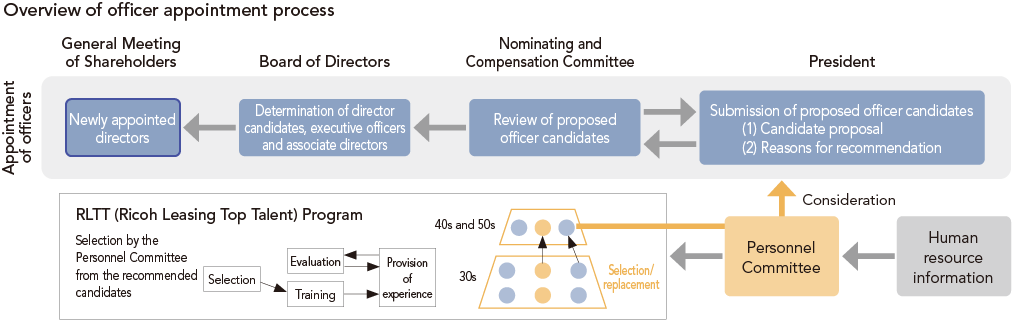

Succession planning

We implement a training program called the Ricoh Leasing Top Talent (RLTT) Program for staff we consider to be potential future candidates for the CEO position. In this program, the contents of which are provided in RL Miraijuku sessions, President Nakamura serves as senior instructor, conveying his own views and ideas as management philosophy, and cultivates the perspectives and viewpoints of management among trainees. With management team members (including outside directors who are members of the Nominating and Compensation Committee) and outside specialists chosen by the President as speakers, it includes lectures and interactive communications to broaden the knowledge required by next-generation leaders.

The Nominating and Compensation Committee assesses human resources through reports regarding business execution by each executive officer at meetings of the Board of Directors.

Based on these evaluations, the Nominating and Compensation Committee deliberates on candidates for positions such as the next CEO, directors, and executive officers as recommended through advice from the Personnel Committee, which comprises internal directors. In addition, taking into account the candidates' performance, results of 360-degree feedback, and information obtained through sundry social gathering opportunities, the Nominating and Compensation Committee reports to the Board of Directors about the final candidates.

In addition, the Nominating and Compensation Committee considers succession planning to be one of the most important issues that the President must exercise leadership in addressing, and checks the progress of succession planning in the annual evaluation of the President.

Policy on cross shareholding

The Company has established a basic policy of holding shares of a trading partner's stock in order to maintain and strengthen stable trading relationships with said trading partner if it is necessary for the enhancement of the Company's corporate value over the medium- to long-term.

The status of the Company's business with such business partner and the significance of the cross shareholding are validated periodically and results are reported to the Board of Directors. A cross shareholding is reduced if the necessity of the cross shareholding is diminished.

Ricoh Leasing Group Human Rights Policy

We believe that respect for human rights in our business activities is a vital responsibility that companies must fulfill, and we have agreed to and signed the United Nations Global Compact (UNGC), and we are continuing our activities to realize the 10 principles in the four areas listed by UNGC (human rights, labor, environment, and anti-corruption).In light of the challenges and changes in awareness of human rights in the international community, we have formulated and committed to our human rights policies with the aim of respecting human rights in our business activities.Aiming to realize a prosperous future, we will contribute to the sound and stable development of a sustainable society and economic together with our stakeholders.

Investment primarily in Loans Policy

Based on our philosophy of sustainability, the Group aims to contribute to the resolution of social and environmental issues through its business activities and to play an active role in building a sustainable society.We prohibit or restrict primarily in Loans investments in businesses and companies that have a significant social impact.

With regard to sectors where there are concerns about climate change and impacts on biodiversity, we will contribute to the creation of a sustainable society by sharing awareness of environmental issues through engagement with suppliers, taking into account international certification and local certification.

Anti-Takeover Measures

We have not introduced anti-takeover measures.