Themes and Policies

| Theme |

Collaboration and collaboration with the community

|

|---|---|

| Policy |

The Ricoh Leasing Group provides some 6,000 vendors with sales support to aid its

400,000 customers with their business activities. In order for the Group to sustain

profitable growth, we will provide new value beyond our traditional leasing business by

accurately responding to changes in society, markets, and customers. We aim to resolve social issues in each region and create a virtuous cycle for the local economy by providing fine-tuned services to customers and vendors based on our strong network of bases nationwide, from Hokkaido to Okinawa, and the economic circumstances of each region. |

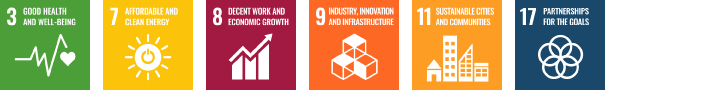

Addressing growing demand for LTE communication enabled PCs

Techno Rent Co., Ltd.

ICT Sales Division

General Manager of

Business Department 2

Techno Rent is in charge of the Group’s rental business, handling the

rental of various equipment including PCs and measuring instruments.

Among them, demand for PCs with LTE communication capabilities is

growing. One of the reasons for this growing demand is that workers are

more often carrying around PCs due to diversifying work styles, as seen in

examples such as telecommuting in the post-pandemic world. Due to

greater transportation, traditional PCs face increased time and effort

required for tethering with a smartphone each time and the instability of

the communication environment, as well as increased security risks such as data leakage, or even

loss or theft of the PC itself. However, the use of LTE-enabled PCs can solve these issues.

Therefore, Techno Rent is providing rental services for LTE-enabled PCs in collaboration with

partner companies. There are two main advantages to using LTE-enabled PCs. The first is greater

convenience; once the PC is turned on, it has immediate network connectivity and access to a

stable communication environment in any environment, such as at home, on the road, or in the

office. Second is stronger security; limiting access to free Wi-Fi through mobile device

management tools and other means reduces the risk of data theft and unauthorized access.

Furthermore, in the unlikely event that the PC is lost or stolen, data can be erased or locked, and

the computer can be found remotely, preventing information leaks.

Currently, the spread of PCs equipped with LTE communication functions in Japan lags

behind that of other countries, and these are expected to see further expansion in the future.

Techno Rent will contribute to business efficiency and risk reduction by proposing solutions to

customers’ internal issues and problems, including business operation improvement, through

measures such as popularizing LTE-enabled PCs.

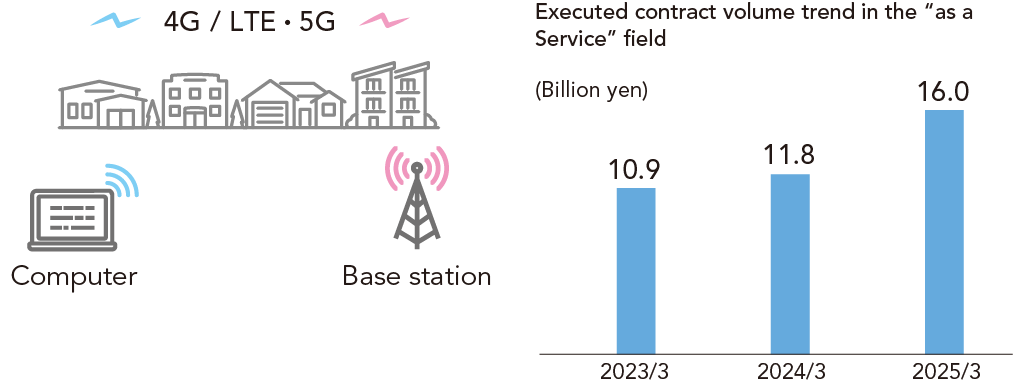

Status of the three priority fields

In capital investment, we support growth opportunities for companies by lowering the hurdles for

capital investment in the construction machinery, vehicles, agriculture, printing, and machinery

sectors. Particularly in the fields of construction machinery, vehicles, and agriculture, a severe

shortage of human resources has created expectations for labor savings through the use of

machinery and new ways of working utilizing IT. Against this backdrop, we have positioned

construction machinery, vehicles, and agriculture as priority fields, and will seek to solve social issues

through partnerships with vendors, which is one of the strengths of our Group.

In the construction machinery and vehicle fields, we will work to expand transactions with

manufacturers’ dealers and distributors, while at the same time promoting labor-saving measures by

expanding EV and recharging facilities and supporting capital investment in ICT construction, where

information and communication technologies are utilized at construction sites and other locations.

In the agriculture field, in response to the demand for funds to improve productivity and increase

the size of livestock farms, we provide equipment used by livestock farmers not only on a lease or

installment sales basis, but also provide financing using beef cattle as collateral.

Initiatives in the construction machinery field

In the construction industry, there is a growing need for construction machinery to cope with aging

infrastructure, including cases where high-performance and high-value machinery is necessary and

where financing is a major barrier for SMEs. Ricoh Leasing is indirectly supporting the development

of local roads, bridges, water, sewage, and other infrastructure by precisely calculating residual

values based on appropriate property value evaluations and by reducing companies’ burden of

introducing this machinery.

Through support for the introduction of ICT construction machinery, we will continue to help

companies to improve the efficiency and safety of construction work amid increasingly serious social

issues such as aging construction machinery operators and shortages of human resources.

Initiatives in the vehicle field

With revisions to work style-related laws taking effect in April 2024, labor shortages in the logistics

industry have become more profound. We provide support for streamlining transportation and

improving working environments by stimulating the introduction of new trucks and renewal of

company fleets through alliances with truck vendors nationwide.

In future efforts, we will promote the creation of a model for sustainable logistics and economics

through support for introducing vehicles with high environmental performance (hybrid/electric

vehicles, etc.).

Initiatives in the agriculture field

In the agriculture field, we provide multifaceted support to farmers in cooperation with various

related organizations to preserve Japan’s food culture, including the use of ABL and leasing, and

combining national and local government subsidies with our financing.

The agriculture and livestock industries are facing serious challenges, such as a shortage of

workers and a low self-sufficiency rate. Through the introduction of smart agriculture, we will help

members of the next generation enter these industries and help producers stabilize their business,

thereby contributing to the preservation of Japan’s food culture and the realization of sustainable local communities.

ESG investment program

In 2020, Ricoh Leasing established a fund of 20 billion yen to launch new businesses by investing in companies and businesses, primarily start-ups and venture capital funds, while taking ESG factors into consideration. We have invested in or otherwise funded several companies, with cumulative investments totaling 18.8 billion yen by the end of fiscal 2024. Through collaboration with portfolio companies and demonstration experiments for business creation, we will work to increase the value of these portfolio companies while simultaneously creating new value to help achieve a sustainable circulation-oriented society.

Collaboration with A.I.Viewlife Co., Ltd.

In recognition of the labor shortage, workload, and inefficiencies around nursing care operations in that industry as social issues, in December 2023 we invested in A.I.Viewlife Co., Ltd., which develops and provides the A.I.Viewlife independence-support nursing care monitoring robot. In fiscal 2024, we introduced this monitoring robot to some facilities at Group company Welfare Suzuran. In addition to enabling quicker response to sudden changes in condition, privacy-conscious monitoring promises to reassure residents and their families, as well as add value by reducing the burden of nursing care and improving service quality. Going forward, we will continue to work on solving social issues through collaboration with our portfolio companies and through demonstration experiments.

Monitoring robot

A next-generation nursing care robot that prevents the leakage of personal information and protects privacy, aiming to support residents’ independence and to prevent them from becoming severely ill by visualizing nursing and care workplaces and by monitoring residents without restraining their movements

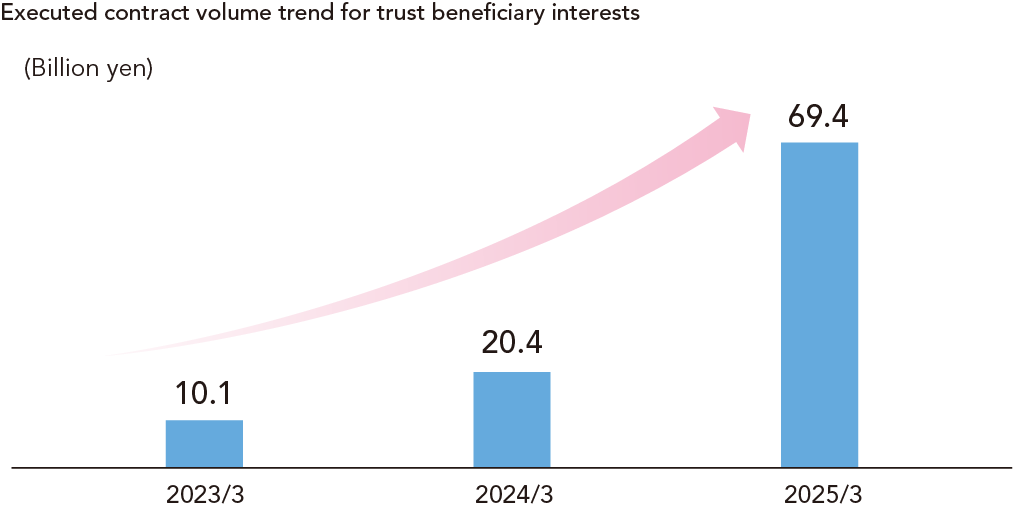

Expanding investment in logistics facility trust beneficiary interests

The logistics environment has recently shown signs of a rapid move toward small lots and increased

frequency, with doubled logistics transactions despite decreasing cargo volume per shipment—

down to about one-third over the past 30 years—and total volume of cargo decreasing by about

40%. This is due in part to the effects of just-in-time delivery by shippers and others, reductions and

eliminations of inventories, and the trend toward more diverse products and smaller lots in business

transactions due to increased demand for courier services. As a result, the scale of logistics facilities

has been expanding and utilization rates have been on an upward trend. With the ever-increasing

importance of logistics, logistics facilities face a variety of challenges, such as aging and policy

arrangements mindful of the future.

In this environment, the market size of real estate securitization, including for logistics facilities,

is expanding year by year. For Ricoh Leasing, investment in trust beneficiary interests in fiscal 2024

increased significantly from the previous fiscal year, with a particularly large increase in investment

targeting logistics facilities. We will continue to contribute to solving issues surrounding logistics in

Japan through investments in trust beneficiary interests.