Following a year of record profits, efforts to further address

rising interest rates in fiscal 2025

In fiscal 2024, we achieved record profits thanks to efforts to grow operating assets while continuously improving contract yields. We recognize that both the Leases & Finance and Investment Businesses had strong growth in operating assets. However, the question remains as to how to identify investment opportunities for growth. Furthermore, counting from the lifting of negative interest rates, Japan's policy rate has effectively been raised three times. To address this rapid rise in interest rates, it is necessary to improve yields in acquiring new contracts, though it takes a certain period of time for operating assets to be replaced by contracts fitting the new level of interest rates. Therefore,we believe that commission businesses and rentals, which are affected less by interest rates, will become increasingly important.

Fiscal 2025 is the final year of our Mid-term Management Plan (“Mid-term Plan”). However, we expect this to be a period of perseverance due to factors such as the increased cost of funds from the aforementioned higher interest rates. For our gross profit before deducting financial expenses, we expect to securely finalize at 55.4 billion yen, compared with 53.0 billion yen planned. The balance of operating assets is expected to be 1.3 trillion yen, compared to the planned value of 1.24 trillion yen. In these respects, the forecast exceeds the planned value and is expected to achieve the Mid-term Plan's goal in terms of business growth. However, the cost of funds is forecast to increase by 3.6 billion yen from the previous fiscal year due to the heavy burden of rising interest rates, and operating profit and all following profit stages are expected to fall short of the planned figures.

Despite the efforts of each of the Leases & Finance,Services, and Investment Business domains, it has been challenging to absorb the entirety of this interest rate burden. Given the rapid rise in interest rates, it is inevitable that we will temporarily stumble; however, we will continue to make every effort to minimize the impact on earnings. In terms of demand forecasts, we expect a certain degree of demand from factors such as Windows migrations, as well as capital investment aimed at improving corporate efficiency and productivity. In light of these trends, we will make steadfast efforts to achieve results on the sales side that exceed our initial plans. At the same time, we plan to invest steadily for sustainable growth in the coming fiscal years.

Cooperative pursuit of sustainable development by providing value exceeding customers' expectations through independent finance and services

In 2020, I was appointed President just as the COVID-19 pandemic was unfolding. I still clearly remember hearing children's voices from outside when I was working from home during the days when I could not even come to the office. Kids can’t just be cooped up at home all the time, and hearing their happy, spirited voices as they ran around outside, I strongly felt that we had a duty to protect the future of these children. From there, I became even more convinced that the business itself must be sustainable.

If companies continue to pursue profits alone, they will eventually reach limits and go bankrupt. That is why I believe that it is necessary to exercise restraint so as not to overstep ethical boundaries, and that our business must be supported by society and the people around us.

Through our finance and services businesses, we provide value by lowering the hurdles for companies to make capital investments. We then provide our customers with proposals and services that add further value, and receive revenue in return.

However, this revenue should not be a transitory thing; it must be sustainable. By exceeding customer expectations and continuing to create value, we create permanence for both our customers and our Group. That is why I think it is important to continue to firmly exceed the expectations of our customers, rather than just earning whatever we can. As symbolized by Rongo to Soroban by famed industrialist Eiichi Shibusawa, our fundamental stance is to balance morality and economics.

We will continue to exceed expectations in a way that is uniquely our own, founded in our corporate philosophy that "We will be a bridge to an abundant future with our independent finance and services."

Strengthening non-asset businesses

through horizontal deployment of strengths fostered in the leasing business

The Group's business originated in the office field, focusing on sales support for copiers and other office equipment. Based on the breadth of customers and expertise gained through our endeavors, we have sought new areas for growth and have evolved and expanded our business domain while maintaining our core strengths. We are currently promoting a variety of new initiatives, and we are reaffirming the importance of the office field, the origin and strength of our Group. This was due to an internal sense of crisis that we had been stuck in the status quo due to excess focus on new domains.

However, our ability to take on challenges in other domains is essentially predicated on our strength in the office field. In other words, we believe that becoming the undisputed top player in the areas in which we excel will be persuasive in our expansion into other domains. For example, based on insights in the office field, our Group excels at handling small-amount and small-lot transactions.

Naturally, administrative processing volume is enormous and costs are higher than for large contracts, when compared by unit. To deal with this, we have refined our efficiency in administrative processes. The series of processes with vendors and customers, starting from the screening request to lease expiration, still involves a great deal of procedures on paper, and applying IT only covers a part of these processes. Therefore, we will rigorously digitalize to effect even greater streamlining.

Standardization is a necessary precondition for such efforts. First, we will review all business processes and thoroughly standardize them, using this to pursue greater efficiency. Customers will also be asked to make the digital transition, which will make procedures smoother and faster. We hope to create a system that enables efficient and valuable transactions for both parties.

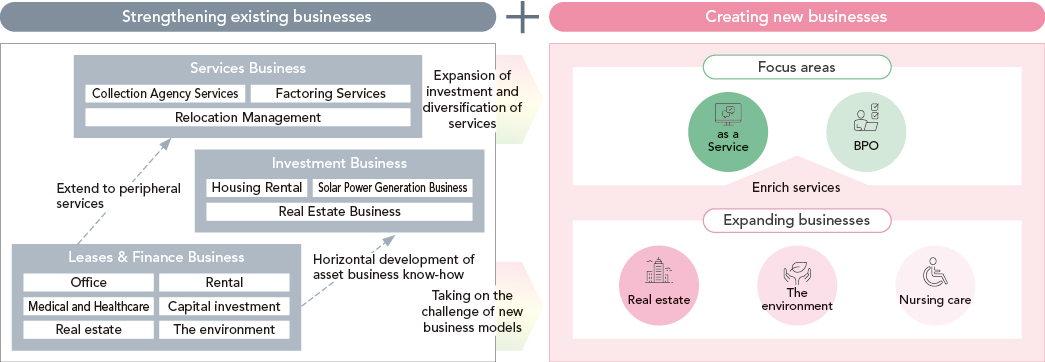

We will aim for expansion accompanied by efficiency in our most important business foundations, such as the office field, and at the same time, we will expand businesses not reliant on assets as a way to take on the challenge of new business models. One aspect of leasing is that it allows us to perform a wide variety of tasks, such as paying property taxes and signing insurance policies. Even the lease contract itself has the advantage of handling the customer's administrative work on their behalf, and we recognize this as an area where we can provide new value that only we, with our strength accumulated through lease contracts mainly in the office field, can offer. We will focus on two business areas in particular: “as a Service” and BPO.* The BPO field includes collection agency services such as account transfers and convenience store payment collection, as well as the relocation management business that provides total support for accepting foreign nationals. Collection agency services is an area that derives from our original strengths and is a business with which our Group has a high affinity. Since it essentially involves no assets, it also has advantages in terms of capital efficiency, and transactions in this area have been growing steadily.

In the “as a Service” field, we integrate equipment such as PCs with related services in order to reduce the burden on corporate IT departments. For example, we provide rentals of computers for office use with pre-installed security software and provide services for their configuration and in case of breakdowns, so that they can be used immediately and at any time. These days, computers and cars are valued more as tools for doing work than as assets, and needs have shifted from the idea of owning things to purchasing functionality. We hope to accurately grasp these changes and incorporate functions that can be turned into tools into “as a Service” businesses.

Vital to strengthening this field will be different infrastructure aspects to our leasing business, including logistics and backyards where PCs are worked on and stored. While outsourcing is possible for logistics, it is essential to have our own backyard, and we will actively invest in this area, including exploring automation, in order to increase the speed, technology, and quality of our service delivery.

“People” are also a key element in conjunction with this. In addition to securing human resources, it is also essential to improve their capabilities to ensure they can handle greater challenges as the business expands and becomes more sophisticated. We will steadily invest in these areas to ensure that the growth of our business remains unwavering.

- ※BPO (Business Process Outsourcing): Outsourcing part of a business process to a specialized business

People and education: Investment in human resources is essential for greater competitiveness

The Ricoh Leasing Group is not a manufacturer. Therefore, we believe that our most important asset is not our physical products, but each employee. With regard to investment in people, in fiscal 2025, we are focusing on strengthening investment in education for each employee and instilling the habit of learning.

Moving forward, we plan to establish clear difficulty categories for the acquisition of qualifications, including those that are difficult to obtain, and to prepare an incentive system by difficulty level. For each employee, it will be important for them to find the “mountain they want to climb,” so to speak, and to be willing to take on the challenge it presents. A clear return gained by climbing that mountain encourages autonomous learning and growth, which in turn leads to improved business performance and organizational strength.

We have also raised salaries over the past several years, with a 10% rate increase. We also raised salaries for fiscal 2025 by 5% as well. By investing in human resources in terms of both compensation and skill development, we will steadily strengthen our competitiveness.

Furthermore, we intend to make more impactful investments in our people in the next Mid-term Plan starting in fiscal 2026.

Steadily making necessary investments in growth areas while practicing balance sheet management

From a financial point of view, if our Group's operating profit is approximately 20 billion yen and profit attributable to owners of parent is 14 billion yen, cash flow of at least 14 billion yen will be generated. How this is allocated is the key to management. Without investment in growth areas and investment in systems and human resources to support our management foundation, we will lose sustainability even if we prioritize returns to shareholders.

One topic of consideration is how specifically to invest in human capital, as previously mentioned. The Board of Directors is deepening discussions on what areas to invest in and how to invest, in order to clarify this information in the next Mid-term Plan. Meanwhile, we also see M&A as a means of evolving to stimulate growth. However, the Company is not one that frequently engages in M&A, but is instead cautious with respect to the practice, limiting it to those deals that will strengthen our business and only if they are essential to our growth.

In terms of capital policy, we believe that financial soundness, as well as ROE and P/B ratio, are important considerations and as such, we must seek to improve ROE. Improving our P/B ratio is also important. We see the improvement of ROE as an effort linked to progressively improving the P/B ratio. In this process, we believe that balance sheet management in accordance with our capital strategy is necessary.

Our cost of shareholders’ equity calculated with CAPM is in the mid-5% range, and while our ROE has remained above that level, we recognize that our ROE has not reached the level that capital markets expect from our Group. We are prepared to take appropriate measures to fill this gap. Along with proper management of the balance sheet, we will continue to focus on returning profits to shareholders through continuous dividend payments, rather than transitory share buybacks.

Aiming to be a Circulation-Creating Company, linking moral efforts to economic value

Our medium- to long-term vision is “Become a Circulation-Creating Company.” This demonstrates how important we feel it is to develop a cycle for corporate growth opportunities and social and economic value as we work to resolve social issues through the material issues we have identified.

To return to the analogy of Rongo to Soroban, material issues are the rongo (teachings, referring to Confucius's Analects), i.e., a moral commitment. However, I believe that morality is not the sole outcome of these material issues, but that they also result in soroban (abacus, the pursuit of profits) as economic fruit. Of course, there are limits to what the Ricoh Leasing Group can do to solve social issues, but the important thing is to persistently work to solve them regardless. We believe that the capital investment we handle in our business and the continuous circulation of goods will itself support corporate entities and contribute to solving social issues. Furthermore, by continually engaging in both rongo and soroban, both society and our Group will grow together. We hope to continue to be a company that creates such a virtuous cycle.

Through this cycle, we aim to realize our corporate philosophy: "We will be a bridge to an abundant future with our independent finance and services." To ensure that each division sees our corporate philosophy as their own, division policies include our philosophy and other measures are taken to ensure the understanding of each department, and furthermore to instill it throughout the Group.

Multifaceted, rigorous governance

through a new forum for monitoring plan

progress and exchanging opinions

The Group's Board of Directors currently consists of 13 members, 8 of whom are outside directors. The majority of directors are independent outside directors, and more than 30% of directors are female. We recognize that this is a very strong structure in terms of both diversity and governance. In addition, the term of office for outside directors and Audit & Supervisory Committee members is capped. As a result, we have a system where one to two new directors are added each year, ensuring that the Board of Directors is not a fixed entity and that new perspectives are constantly being incorporated in our governance.

In addition, the breadth of our business is currently expanding through M&A, and people with different backgrounds are joining the organization. I believe that one of our most important tasks going forward is to firmly share the corporate philosophy and values of our Group and align our direction as a whole.

In this context, in addition to meetings of the Board of Directors, individual meetings on the Mid-term Management Plan are held from time to time to provide a forum for more in-depth discussions on each topic. Informal exchanges of opinion consisting solely of independent outside directors (the Independent Directors Roundtable Meeting) are also held on a regular basis, where no minutes are kept and free exchange of opinions is encouraged to promote frank and constructive dialogue. In this way, we continuously monitor and exchange opinions on business and management from both on-site and off-site perspectives, and we recognize that a healthy and open discussion cycle has been formed outside of Board of Directors meetings.

Message to stakeholders

Many people have an image of Ricoh Leasing as a serious and reliable Group. This solid presence is our corporate foundation and will continue to be important going forward. It is on this basis that we intend to achieve sustainable corporate development while steadily investing in growth. At the same time, we also place great emphasis on distributions to shareholders, especially with regard to dividends, and we intend to continue our progressive dividends as much as we can.

We will make further efforts to ensure that our stakeholders understand our approach and stance, and that we continue to present ourselves in a way that they can support us with confidence.