Support for the TCFD and TNFD

The Ricoh Leasing Group views climate change and diversity as serious topics that will have a significant impact on corporate value and business strategy decisions. With respect to climate change, we endorse the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board, and are committed to proactively disclosing information based on our analysis of risks and opportunities in this area.

Going forward, we will work to disclose information based on the SSBJ standards developed for Japanese companies in light of the IFRS Sustainability Disclosure Standards (S1 and S2) for international accounting. In April 2025, we also endorsed the principles of the Taskforce on Nature-related Financial Disclosures (TNFD) and participate in the TNFD Forum, which supports its activities. In order to properly understand and assess the relationship between our business activities and biodiversity, we will conduct analysis based on the LEAP approach recommended by the TNFD and take step-by-step actions toward information disclosure.

Table of Correspondences with the TCFD Framework

| Disclosure Item | Relevant Section | |

|---|---|---|

| Governance | Companies disclose the role of board oversight and management in assessing and managing climate-related risks and opportunities. |

|

| Strategy | Companies disclose climate-related risks and opportunities (identified over the short, medium, and long term) and their potential impact on the organization’s businesses, strategy, financial planning, and corporate governance. Also, describe the resilience of the organization, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. |

|

| Risk Management | Companies disclose their processes for identifying, assessing, and managing climate-related risks and how these processes are integrated into the organization’s overall risk management processes and strategies. |

|

| Metrics and Targets | Companies are required to disclose the metrics and targets they use to measure their success in addressing climate-related risks and seizing climate-related opportunities. In addition, they disclose transition plans that include actions and activities that will result in effective zero emissions by 2050. |

|

Table of Correspondences with the TNFD Framework

| Disclosure Item | Relevant Section | |

|---|---|---|

| Governance | Organizational disclosure of governance for nature-related dependencies and impacts, risks, and opportunities |

|

| Strategy | Discloses the impact of nature-related dependencies and impacts, risks and opportunities on the organization’s business model, strategy and financial plans, if material. |

|

| Risk and Impact Management | Describes the process by which the organization identifies, assesses, and manages nature-related dependencies and impacts, risks, and opportunities. |

|

| Metrics and Targets | Discloses the metrics and targets used to assess and manage material nature-related dependencies and impacts, risks, and opportunities. |

|

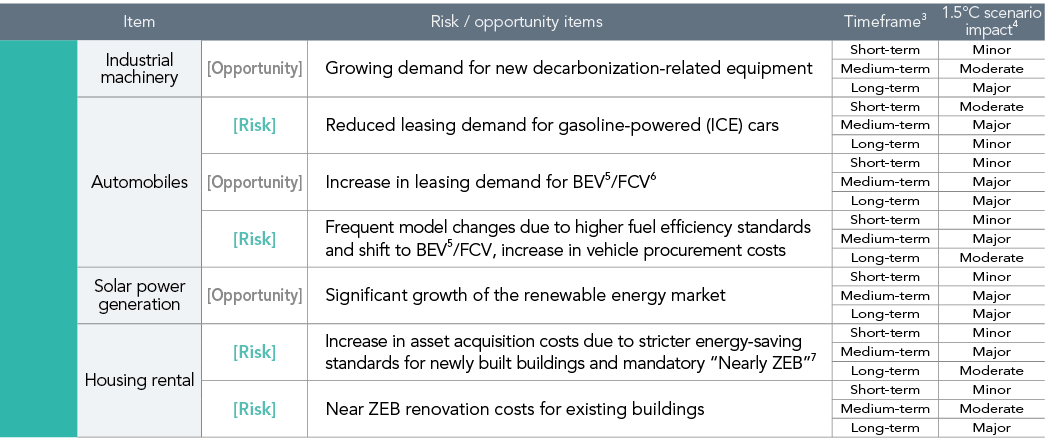

Risks and opportunities of climate change for Ricoh Leasing

We anticipate there to be a risk that the transition to a decarbonized society and the increase in extreme weather due to climate change will affect customers’ businesses. In light of the frequent occurrence of climate-driven natural disasters in Japan in recent years, we conducted a qualitative scenario analysis on five categories of our business [leased assets (office equipment,1 automobiles, industrial machinery), solar power generation, and housing rental] that pose concerns given the financial impact of climate change. We estimated the financial impact for those items identified as having a significant impact on our business.

This year, this quantitative analysis has been updated and the financial impact has been reviewed using the latest future projections.

1.5°C scenario

Scenario where strict measures are taken to counter climate change and the rise in temperatures is contained to around 1.5°C

4°C scenario※2

Scenario where steps to counter climate change are not taken and the temperature rises by about 4°C

- ※1Based on close scrutiny of the effectiveness of this analysis, assuming wind and flood damage to leased office equipment assets and taking into account insurance, etc., we determined that the impact of climate change on our business would be small, and thus excluded it from the quantitative analysis.

- ※2As a result of a qualitative analysis, we determined that the impact of physical risks (impact from damage due to floods, high tides, temperature rises, etc.) under the 4°C scenario on our business would be small. Based on this determination, quantitative analysis was not conducted.

Impact on our business

The results of the scenario analysis, in both the transition (1.5°C) and physical (4°C) scenarios, show generally limited short-term negative impacts from climate change on the Group’s business. In addition, analysis results show that, in overall terms, the opportunities are larger than the risks,suggesting that we can expect an increase in sales and profits under the 1.5°C scenario.

For more information on our initiatives, please see pages 46 and 47 of the Integrated Report.

- ※3Short-term: Present–2026, Medium-term: 2027–2030, Long-term: 2031–2050.

- ※4Major: Over 3 billion yen; Moderate: 0.1–3 billion yen; Minor: Less than 100 million yen.

- ※5BEV (Battery Electric Vehicle): A type of electric vehicle (EV) that runs on 100% electricity.

- ※6FCV (Fuel Cell Vehicle): A fuel cell vehicle that uses electrical energy generated by a chemical reaction between hydrogen and oxygen in a fuel cell to drive a motor.

- ※7Nearly ZEB (Zero Energy Building): Buildings that reduce primary energy consumption by 50% or more relative to standard primary energy consumption, excluding renewable energy sources.

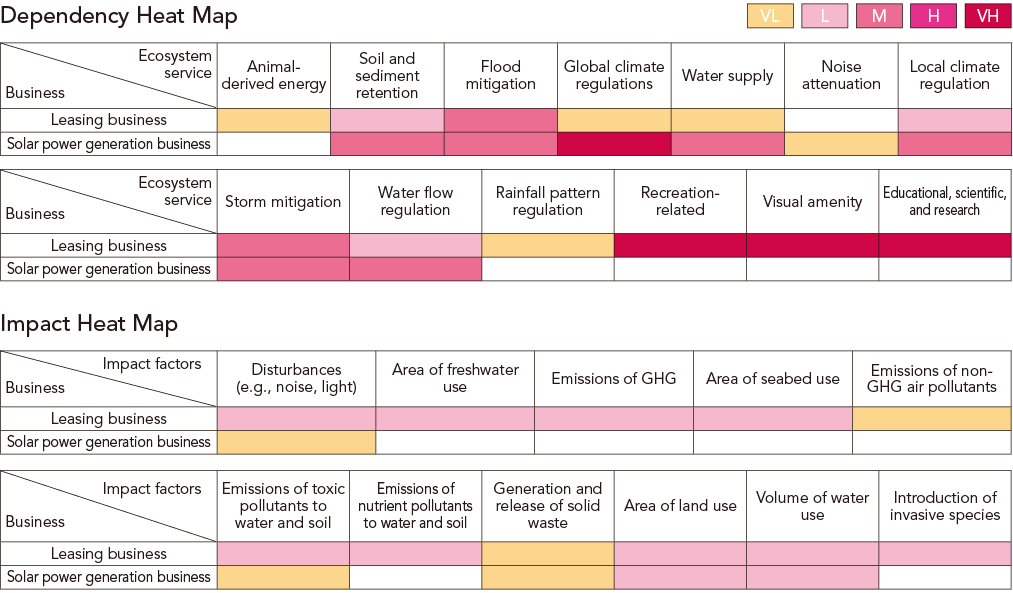

Evaluation of the relationship between business activities and natural capital and biodiversity

Referring to the guidance in the TNFD recommendations (issued in September 2023), we conducted an analysis of the relationship between our business activities and natural capital and biodiversity, using internal surveys and external tools, with a limited scope of coverage given that it was our first year of disclosure. As of this report, we have not identified any relationship that would have a significant impact on our business activities, but we will gradually expand the scope of our analysis to identify and evaluate more specific risks and opportunities.

| General Requirements | |

|---|---|

| Application of materiality | Disclosure is made from the perspective of double materiality, which analyzes and evaluates not only the impact on the Company’s business activities, but also the impact on natural capital and biodiversity. |

| Scope of disclosure and areas with nature-related issues | For this first year of analysis and disclosure, the scope includes Ricoh Leasing Company, Ltd.’s business activity sites and owned solar power plants to evaluate the relationship between each location and its business activities and natural capital and biodiversity. Solar power plants were included in analysis because, while they can contribute to the realization of a decarbonized society from the perspective of climate change issues, panel installation could conceivably have an impact on biodiversity. We are considering expanding the analysis scope and content in stages going forward. |

| Integration with other sustainability-related disclosures | As of this report, we have not yet achieved a comprehensive and integrated analysis of climate change and nature-related issues, but we are aware of their potential interrelationships and will work to enhance our analysis and disclosure from a more integrated perspective. |

| Target periods |

As with the TCFD, we define the periods as follows. Short-term: Present—2026, Medium-term: 2027—2030, Long-term: 2031—2050. |

| Engagement with indigenous peoples, local communities, and affected stakeholders in identifying and assessing the organization’s nature-related issues |

The Ricoh Leasing Group respects international human rights norms, including the International Bill of Human Rights and the ILO Declaration on Fundamental Principles and Rights at Work, and strives to achieve a sustainable society by respecting human rights in accordance with the Ricoh Leasing Group Code of Conduct. In addition, we conduct human rights due diligence to identify and prevent or mitigate negative human rights impacts on our Company, Group companies, suppliers, or other entities, including local communities. In this process, we also identify and evaluate impact on the environment, including biodiversity. Going forward, we will continue to work with each of our stakeholders to balance environmental conservation in local communities with sustainable economic activities. |

Business and Biodiversity

External tool used: ENCORE

In order to determine the extent to which our company’s business activities depend on ecosystem services* and how they impact the natural environment, we conducted an analysis using ENCORE, a globally standard tool. The purpose of this analysis is to ascertain the general relationship in the industry to which we belong. In the future, we will be aware of the items identified as highly related in this analysis and will proceed with a more detailed examination of whether there are any dependencies or impacts that are unique to our company.

- ※Ecosystem services are the benefits to economic and other human activities generated by ecosystems from natural capital. For example, sharing timber and firewood in forests, recreation and tourism opportunities on coral reefs, flood mitigation, crop pollination, etc.

Business Sites and Biodiversity

External tools used: Biodiversity visualization map by Ministry of the Environment, IBAT, Aqueduct

We conducted a survey using external tools to determine whether our own business sites (Ricoh Leasing offices and solar power plants) are located in areas important for biodiversity conservation or areas of high water stress.

Our survey confirmed that some business sites are located in or adjacent to these areas, but as our Toyosu office, for example, is located within the Tokyo Bay area, which is under a blanket wildlife protection area designation by the Tokyo Metropolitan Government and is actually located within an office building, it is not in close proximity to the natural environment. As such, we have determined that there are no business sites that require special measures at this time (the solar power plant does not operate within an important area for either of the above considerations).

Going forward, we will continue to survey and understand the situation by gradually expanding the scope of our analyses.