Themes and Policies

| Theme |

Mitigate and adapt to climate change

|

|---|---|

| Policy | The Ricoh Leasing Group has set its target for net-zero emissions under Scope 1 and 2 for 2030, and aims to reduce its own CO2 emissions to net-zero through thorough energy conservation, while contributing to the realization of a decarbonized society by promoting renewable energy and expanding the use of environmentally friendly products. In addition, amid concerns about the tight supply and demand of resources and energy, we will aim for sustainable management, efficient use of natural resources, and significant waste reductions. We promote the reuse and recycling of facilities and equipment after leasing ends, as well as the sharing of rental equipment, thereby promoting the effective use of resources and contributing to the realization of a recycling-oriented society. |

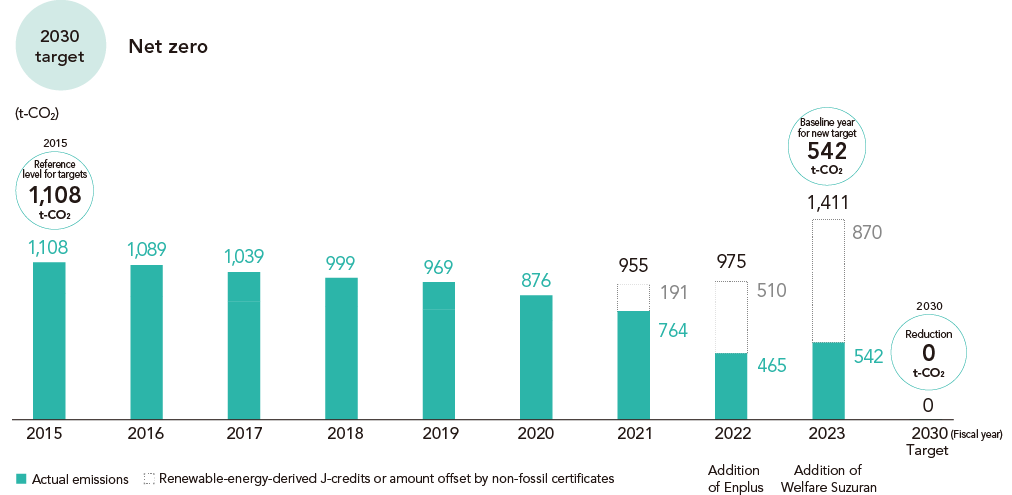

Medium- and long-term CO2reduction targets

The increase in greenhouse gases, principally carbon dioxide (CO2), has resulted in various impacts and damages to the natural environment and human life in many parts of the world, and the severity of these impacts has led to the term "climate crisis." Since the 2015 Paris Agreement, which was agreed upon in an effort to mitigate climate change, companies have been called upon to work on reducing greenhouse gas emissions in their business activities. In response to the SBTi,* an international framework that calls for greenhouse gas reduction targets consistent with scientific findings, which raised the standard for setting targets to 1.5°C, the Ricoh Leasing Group has set a goal of achieving zero CO2 emissions throughout its value chain by 2050. Additionally, in September 2023, we moved up our targets for net zero emissions in Scopes 1 and 2 to 2030. With regard to the baseline year for the target, with the addition of Welfare Suzuran Co., Ltd.’s emissions to Group results in FY2023, we have set FY2023 as the new baseline year for our CO2 reduction efforts. To achieve our new targets, we will identify risks and opportunities in the Group and contribute to solving social issues through our efforts to "contribute to a clean global environment," one of our material issues.

- ※SBTi (Science Based Targets initiative): A joint initiative that encourages companies to set reduction targets consistent with scientific findings toward the goal of limiting the increase in average global temperatures due to climate change to 1.5°C above preindustrial levels.

Scope 1 and 2: Initiatives to reduce environmental impact through our business activities

In fiscal 2024, amounts for each type of energy increased in proportion with growth in our sales activities, but emissions were reduced thanks to a higher share of renewable energy in electricity consumption. As for company vehicles, the switchover from gasoline-powered vehicles has already been completed, and we now have a total of four EVs in the fleet. To further promote decarbonization efforts, we have decided to introduce internal carbon pricing (ICP) on the purchase of company vehicles at a rate of 19,669 yen per t-CO2. Our ICP initiative will first target vehicles, and we will consider expanding investment scope going forward. After purchasing and redeeming 829 t-CO2 of the Ricoh Leasing Group’s electricity with tracked FIT non-fossil certificates from our solar power generation facilities, total CO2 emissions amounted to 513 t-CO2.

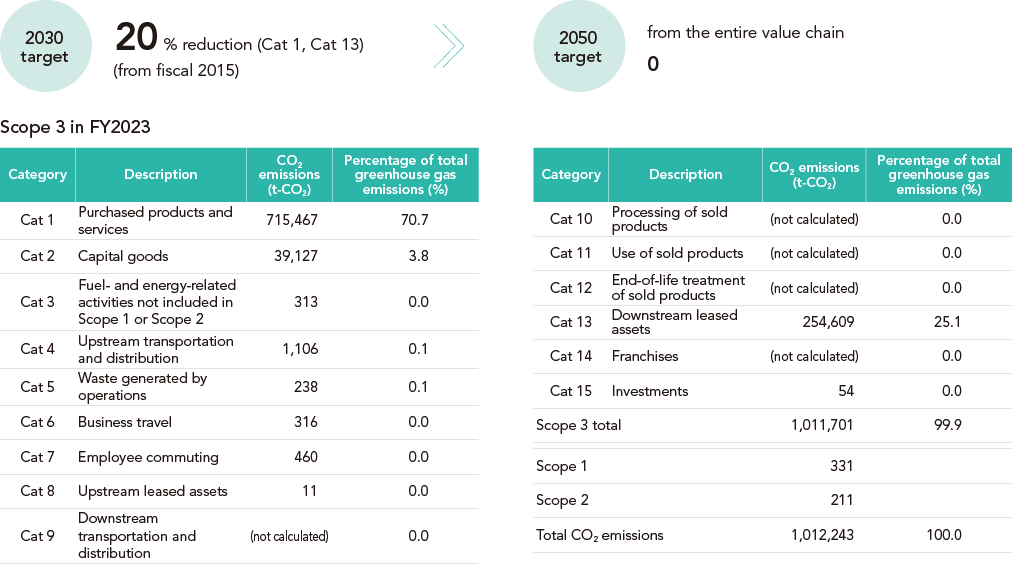

Reduction of CO2 emissions from the entire supply chain through the calculation of Scope 3 emissions

Scope 3 emissions account for 99.9% of the Group’s GHG emissions and, by our efforts since fiscal 2013 to calculate and disclose Scope 3 emissions, and by estimating and disclosing CO2 emissions to customers when they use leased equipment, we have been working jointly with customers toward reduction of CO2emissions, promoting the spread of environmentally sound equipment. In fiscal 2024, Category 1 and Category 13 emissions increased due to greater sales activities, resulting in a 5% increase over the previous year to 1,058,264 t-CO2.

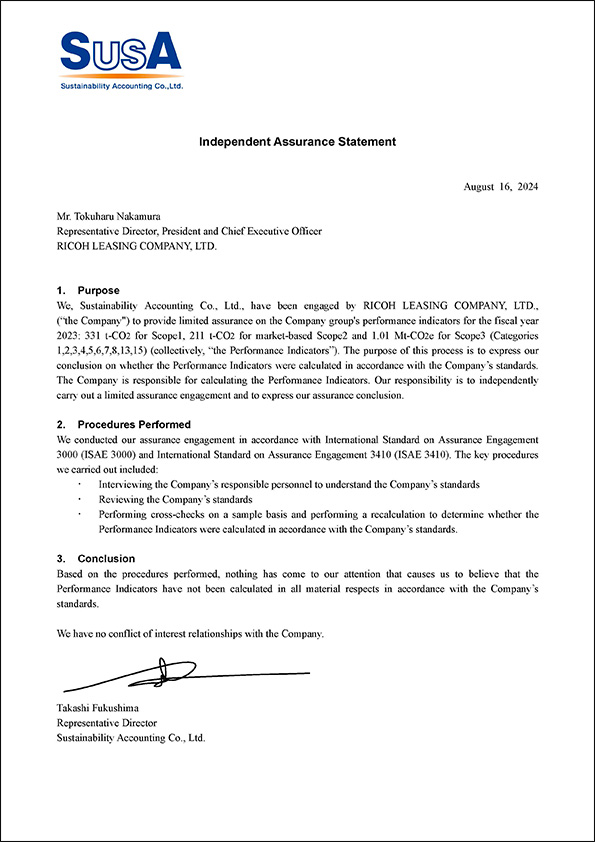

Third-party assurance of CO2 emissions data

Calculations of CO2 emissions data in Scope 1,2 and 3 are assured by a third party, Sustainability Accounting Co., Ltd.

Non-financial Targets

| Indicator | FY2024 achievement | FY2025 targets |

|---|---|---|

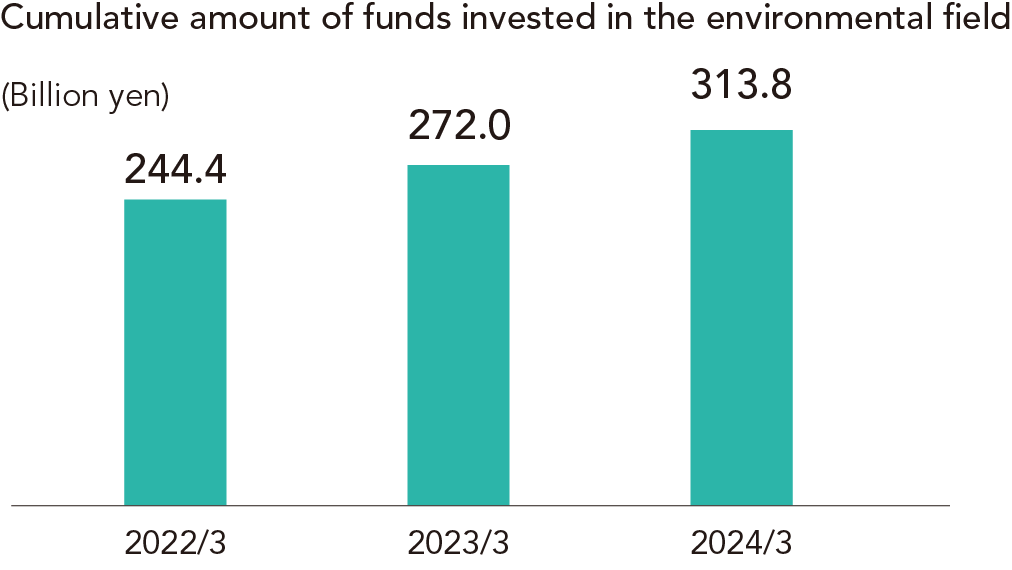

| Cumulative investments in environmental fields※ | 347.7 billion yen | 400 billion yen |

| Renewable energy output | 196,764 MWh | 205,700 MWh |

| No. of EVs in fleet | 949 | - |

- ※Total executed lease and installment sales contracts in the renewable energy sector, as well as solar power generation projects and equity investments

Initiatives in the environmental field

With "contribute to a clean global environment" as one of its material issues, the Ricoh Leasing Group is working, from the perspective of reducing CO2 emissions, to combat global warming and promote renewable energy, i.e., clean energy sources that do not emit greenhouse gases.

With the start of the FIT system, we have arranged financing projects for solar power plants, and have also worked on other power sources such as wind, biomass, and small-scale hydropower. In 2018, we began to invest in becoming a power generation provider ourselves, working on a wide range of projects from those under the FIT system to PPAs, and as of March 2025, we have 625 power generation sites with a total of 224.4 MW of output.

In FY2024, the total amount of cumulative investments amounted to 347.7 billion yen, the result of initiatives including limited partnership investment in a fund targeting new domestic onshore wind power generation projects. Through proactive investment going forward, we will continue our efforts to realize a decarbonized society through our business.

Optimization of our solar power plants through copper wire theft prevention

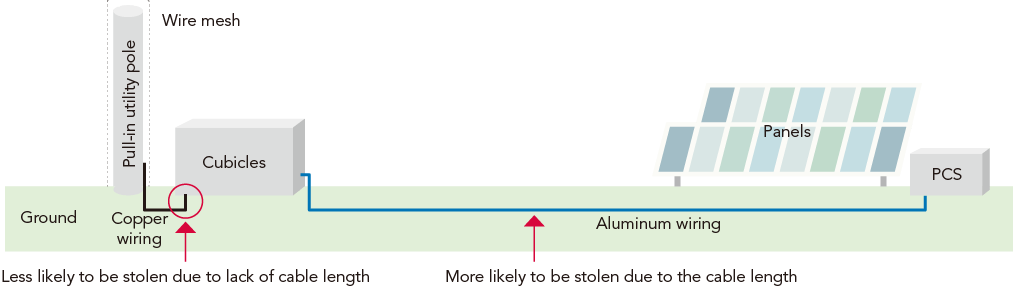

In recent years, the theft of copper wire at solar power plants has become a serious problem due to soaring global copper prices. Compounded by the depletion of copper resources, and with the time required to procure materials to restore facilities after a theft, power generation outages can be prolonged, affecting not only solar power producers but also the stability of the power supply, creating a social issue. Amid this development, we have switched from copper wires to aluminum conductor cables in some of the high-voltage solar power plants we own. This was not carried out to recover from a theft, but instead a planned theft prevention measure. In addition to gains on the sale of the copper wiring we had on hand, the planned switchover work will minimize lost earnings due to power outages. In low-voltage solar power plants, the risk of theft is highest in the vicinity of pull-in utility poles, so strong wire netting has been installed in this area to prevent theft. Specifically, wire mesh is installed at the pull-in poles, at the wiring risers of power conditioners, and at locations where cables are buried underground. Through these theft prevention measures, we will continue to work to minimize the decline in power generation and lost profits, and to achieve the non-financial targets we have set for the environmental field (target of 205,700 MWh of renewable energy generation for the fiscal year ending March 31, 2026). We will also provide support and funding to other power producers to introduce theft prevention measures through our Solar Assist service.

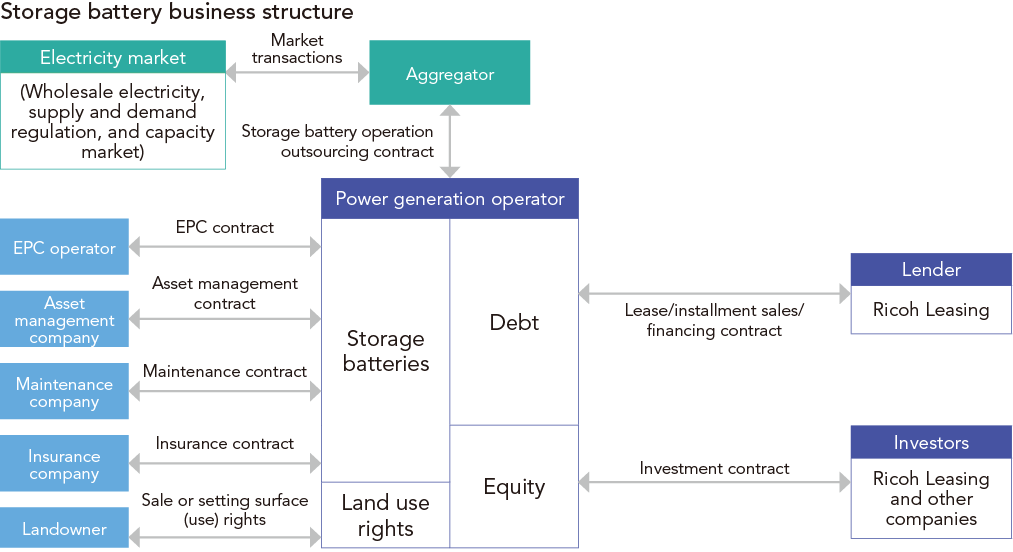

Initiatives for the storage battery business

As the introduction of renewable energy sources expands, electricity supply and demand must be regulated; this has led to an expanded market outlook for the storage battery business as a potential solution to this issue. The storage battery business includes (1) business in which storage batteries are attached to solar power plants and electricity is sold at night and other times when demand for electricity is higher than supply, and (2) business in which storage batteries are directly connected to the power grid and supply their regulating power with the electricity market. While there is a need for both types of business and an increasing number of companies are participating in this area, business feasibility assessments have been challenging and there are few financial institutions capable of structuring project financing. Amid this, we have utilized our expertise cultivated in the solar power generation business to develop a business feasibility assessment model for the storage battery business. Through the provision of funds to battery storage operators, we will contribute to the stable supply of renewable energy. In addition, by utilizing the expertise accumulated through this business, we aim to not only provide funding but also to become a business operator ourselves, thereby making further contributions to the global environment and improving our profitability.